U.S. investors can immigrate to the Netherlands under the Dutch-American Friendship Treaty. According to this agreement, U.S. investors can start a business in the Netherlands if they have the required capital and they can easily become the sponsors for their spouses and/or children if they also wish to move to the Netherlands. American citizens interested in obtaining the DAFT visa can receive assistance from our team of Dutch immigration lawyers.

| Quick Facts | |

|---|---|

| Eligibility | American citizens |

| Governing law | The DAFT (Dutch American Friendship) Treaty, entered into force in 1956 |

|

Used by |

Entrepreneurs |

| DAFT visa validity |

2 years, renewable |

| DAFT visa conditions |

The US citizen applying for this visa will start a business in the Netherlands that will trade between the US and the Netherlands |

| DAFT visa minimum investment amount |

EUR 4,500 (approximately USD 4,795) |

| Application process | An appointment is scheduled with the Immigration and Naturalisation Service. The application is submitted with the Dutch authorities |

| Required documents | Valid travel document, proof of income, proof of lack of criminal record, proof of sufficient income, business incorporation documents |

| Mandatory steps | Opening a bank account in the Netherlands and depositing the minimum capital |

| Steps handled in the Netherlands | Company incorporation in the Netherlands |

| Dependents can join the visa holder (Yes/No) | Yes |

| Types of companies that can be incorporated in the Netherlands | Limited liability company or sole trader |

| Company registration requirements | Mandatory registration with the Netherlands Chamber of Commerce (KVK) |

| Permanent residence in the Netherlands | After a continuous stay of 5 years |

| Reasons to invest in the Netherlands | Good infrastructure Excellent location in Europe Competitive economy Government policies supporting growth, innovation and research |

Under the treaty, American citizens can receive a residence permit that will allow them to live and work in a Dutch city. This permit (also known as DAFT visa) is valid for two years and the holder can apply for permanent residence when all the conditions are met after having lived for five years in the country.

Starting a business in the Netherlands is an easy process, however, many U.S. investors may find it different to establish a business in and move to a European country. Our team of Dutch immigration lawyers is ready to provide entrepreneurs with personalized services for starting a business and benefiting from the provisions of the DAFT Treaty.

What are the general conditions for moving to the Netherlands?

Moving to the Netherlands and starting a business in the country based on a residence permit in the Netherlands can be an attractive option for many foreign investors, not only American citizens. However, the special conditions under the Dutch-American Friendship Treaty (DAFT) make it relatively simple for individuals from the United States to move to a Dutch city.

The DAFT visa is valid for two years and it is suitable for U.S. entrepreneurs who are IT and software specialists, web developers, management consultants, accountants, designers, translators, multimedia producers, and many other specialists who can work as self-employed individuals.

It is important to note that under the treaty the applicant will most likely work as a freelancer as this is not a work permit for an employee. If you are interested in moving to the Netherlands under a work permit as an employee, one of our Netherlands immigration specialists can help you with additional information about this option.

What are the steps for obtaining the DAFT Visa?

U.S. entrepreneurs who wish to apply for a Dutch residence permit under the DAFT Treaty between the two countries need to follow a number of steps and submit their permit application with the Immigration and Naturalization Department, the IND. The first two steps, before submitting the application, include arriving in the Netherlands and arranging the accommodation in a location where the applicant will be able to register as living at the said location. There are plenty of options for renting a property in the Netherlands and one of our Dutch immigration lawyers can help you handle the formalities for renting and even arrange for a note from the property owner that you live there, in case this is requested by the Immigration and Naturalization Department for your application file.

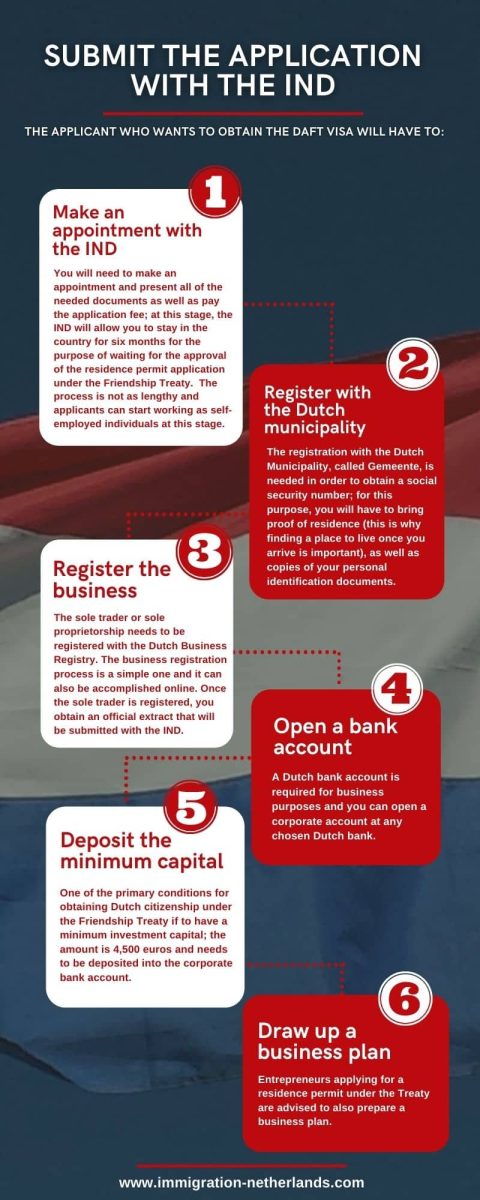

Once the first steps are arranged, it is time to submit the application with the IND. From here onward, the applicant who wants to obtain the DAFT visa will have to:

- make an appointment with the IND: you will need to make an appointment and present all of the needed documents as well as pay the application fee; at this stage, the IND will allow you to stay in the country for six months for the purpose of waiting for the approval of the residence permit application under the DAFT Treaty. The process is not as lengthy and applicants can start working as self-employed individuals at this stage.

- register with the Dutch municipality: the registration with the Dutch Municipality, called Gemeente, is needed in order to obtain a social security number; for this purpose, you will have to bring proof of residence (this is why finding a place to live once you arrive is important), as well as copies of your personal identification documents.

- register the business: the sole trader or sole proprietorship needs to be registered with the Dutch Business Registry. The business registration process is a simple one and it can also be accomplished online. Once the sole trader is registered, you obtain an official extract that will be submitted with the IND.

- open a bank account: a Dutch bank account is required for business purposes and you can open a corporate account at any chosen Dutch bank.

- deposit the minimum capital: one of the primary conditions for obtaining Dutch citizenship under the Friendship Treaty if to have a minimum investment capital; the amount is 4,500 euros and needs to be deposited into the corporate bank account.

- draw up a business plan: entrepreneurs applying for a residence permit under the Treaty are advised to also prepare a business plan.

The following video is a summary of the conditions for the DAFT visa:

How can US nationals work as self-employed persons in the Netherlands?

As previously mentioned, the DAFT visa is suitable for those US nationals who will work in the Netherlands as self-employed persons. This means that they will need to comply not only with the nationality requirements that grant the advantages under the said treaty but also with other criteria that are relevant to the proposed activities. Moreover, foreign nationals who wish to work in the Netherlands will need to provide proof that the activities will offer them sufficient income, as well as comply with other requirements for minimum investments.

The conditions for self-employed persons under the Dutch American Friendship Treaty are the following:

- He or she meets the conditions applicable to all self-employed applicants;

- Has American nationality;

- Does business between the Netherlands and the United States or develops and leads a business in the Netherlands (meaning that the person either represents an American company and is employed by that American company in a key position or has a liberal profession).

Some of the costs associated with working as a self-employed individual are the following:

- the application costs are €1,416 (approximately 1,712$);

- alternatively, the cost of the application is €379 if the holder also has a residence permit start-up;

- provide proof that your income is at least € 1,508.22 (approximately $1,605.24) per month, gross income without holiday allowance.

Please keep in mind that the minimum income listed above is for the residence permit as a self-employed person, and the required amount is for the gross monthly profit valid between 1 July 2023 through 31 December 2023. This amount changes on a yearly basis. Our team of Dutch immigration lawyers can provide more details on the requirements for the minimum income per residence permit. Other categories of income apply for other types of residence permits, for example, those residence permits for staying with a family member or partner.

Requirements for working in the Netherlands

US nationals who wish to work in the Netherlands as self-employed individuals will need to prove that they have the licenses for practicing their profession. This may mean that certain qualifications will need to be recognized and the individual will also need to apply for a certificate of professional competence. In some cases, they will also need to take certain exams in order to receive the recognition of their qualifications and/or register with a professional association. Those who do not have a regulated profession can talk more about the process with our team of immigration lawyers.

Some types of professions are subject to automatic recognition. Examples include architects, veterinary surgeons, pharmacists, dental practitioners, obstetricians, physicians and general care nurses. The process is simplified for these automatically recognized professions in the sense that the corresponding authorities can start the procedure in a much faster manner and once you provide the professional qualifications you will be able, in most cases, to start working in a short amount of time. In other cases, the applicant will also be asked to provide additional documents apart from the diplomas or the relevant professional qualifications.

In addition to observing the different professional qualification requirements, American citizens who move to the Netherlands under the DAFT Treaty will need to comply with the taxes for their form of business. As one can derive income as a self-employed individual or through a company, understanding the different taxation regimes is important when choosing the business form. The two main tax options are paying income tax and VAT for self-employed professionals or paying corporate income tax and VAT for resident businesses. Some services are exempt from VAT in the Netherlands or they are subject to a lower rate. In addition to the taxes, one must also pay health care insurance premiums.

Data from Statistics Netherlands highlights the business environment for self-employed persons (both men and women) in 2021:

- the total number of self-employed persons (for whom the self-employed activity was the main source of income in 2021) was 1,330,000;

- out of the total, 1,011,000 were solo-self-employed, and 297,800 had employees; for the purposes of the statistical data, the types of self-employment also included self-employed entrepreneurs, owner-managers, and other types of self-employed.

Also according to data from Statistics Netherlands’ database, most of the self-employed professionals in the country were men in 2020. In total, there were more than 1,166,000 self-employed professionals in the final quarter of 2020.

The DAFT Treaty provides for benefits both for American citizens in the Netherlands as well as Dutch citizens in the United States. Being able to obtain temporary residence and start working under the terms of this agreement can be one of the reasons why some US nationals may choose to relocate to the Netherlands, as opposed to other countries, when they are looking towards moving to Europe.

Understanding the terms of the Friendship Treaty that allows US nationals to live and work in the Netherlands is essential before arriving in the country. One of our immigration lawyers in the Netherlands can help you submit the application for a residence permit under the Dutch-American Friendship Treaty.

Dutch citizenship for US nationals

As an American citizen in the Netherlands, you will not be able to retain your original citizenship, if you wish to gain Dutch citizenship after five years in the country, should you wish to apply. The naturalization process is one that takes into account the individual’s level of language knowledge, as well as one’s financial independence and integration into society.

While giving up one’s first nationality is required for the naturalization option, it is often not the case for the option procedure. Under law, one can keep his or her other nationality if they are the registered partner or the spouse of a Dutch citizen when he/she becomes a Dutch national.

Becoming a Dutch national is available through naturalization for most applicants, as well as most US nationals who have been living in the country based on the DAFT Visa and are ready to take this step.

- Prepare for application: you can only start your application once you meet the minimum residency requirements; you will also need to gather the needed documents, such as your current residence permit in Netherlands, and others;

- Apply: the application is submitted at the Town Hall in your Dutch city of residence; you will also pay the application fee at this point;

- Wait for the decision: the usual decision period is 12 months; the status of the application can be followed online; our Dutch immigration lawyers can help keep you updated;

- Answer: if the application is approved, the IND will forward your application to be signed by the King through a Royal Decree on Dutch Citizenship; if the application is refused, you have the option to lodge an appeal with the help of our team;

- Ceremony: this is mandatory for all those who wish to immigrate to the Netherlands to become Dutch; in fact, without participating in this, the applicant cannot become Dutch; an invitation is sent by the Town Hall, and, during the ceremony, the foreign national takes an oath (the declaration of solidarity); after the ceremony, the applicant receives the naturalization decision, a document with which he/she will be able to apply for a Dutch passport.

If you are an American citizen who has been living in the Netherlands for five years and you have children under 18 years of age, you can also submit an application for them to become citizens at the same time as your own application.

Some of the advantages of becoming a Dutch national include the following:

- You are no longer conditioned by a maximum period out of the country in order to retain your residence status;

- You become an EU citizen and you can easily move to another EU country, should you wish to do so; you will also be allowed to remain in other EU countries for a longer period without the need to apply for a temporary residence permit;

- You will be able to take up work in the public sector (for example, become a police officer, a soldier, a judge, or a mayor);

- You can vote in all Dutch elections and in European elections.

Losing one’s Dutch nationality is possible in certain, well-defined cases such as if the individual is convicted of a serious offence or if the residence permit/citizenship status was acquired through fraud.

If your goal is to relocate to the Netherlands from USA, our team will assist you throughout the process, as early on as you submit the first application for the residence permit based on the DAFT Treaty, continuing with its renewal as needed, and finally for citizenship, should you choose to take this step.

Remaining in the Netherlands is possible for all foreign nationals who apply for and obtain a residence permit that matches their intended purpose of stay. If you are not an American national and you wish to know more about your option, you can confidently reach out to our team of experts. We can give you complete details on the conditions for residency in the Netherlands.

For more information on the DAFT visa, please do not hesitate to contact us.