According to the Dutch immigration Law, a residence permit is necessary for US citizens who intend to live and work in the Netherlands. There are several types of residence permits in the Netherlands they can apply for. Our immigration lawyer in Netherlands can explain to you how to immigrate to the Netherlands from the USA.

Moving to the Netherlands is an important choice, particularly for U.S. citizens who have never traveled to Europe. Oftentimes, this choice is based on economic and/or work-related reasons, especially because professionals working in Amsterdam or other cities can benefit from a special ruling, as detailed below by our immigration specialists.

Citizens of the U.S.A. should know that a Friendship Treaty is in place between the Netherlands and the United States and it facilitates the manner in which American investors can start a business in a Dutch city. Receiving a residence permit in Netherlands for living and working in the country is facilitated under this treaty, provided that the U.S. investor satisfies the conditions for providing a minimum investment capital for the Dutch business (at least 4,500 euros).

The DAFT visa is the most suitable relocation route for US citizens who wish to open a business or work as self-employed in the Netherlands. The Dutch American Friendship Treaty (DAFT) conditions allow a US applicant to remain in the Netherlands for 2 years, provided that he or she observes the requirements for an investment amount. Our team can give you more details upon request.

| Quick Facts | |

|---|---|

| Visa requirement to enter Netherlands |

No, for stays of up to 90 days |

|

Types of temporary residence permits for those who relocate to Netherlands from US |

Employment, business, study, family reunification |

| Documents for temporary residence permits | Valid passport, no previous offences or crimes, permit-specific documents such as the employment agreement, the university acceptance letter or others |

| Approximate time needed to obtain a temporary stay permit |

90 days |

| Residence permits for investors who relocate to Netherlands from US | Yes, under the Dutch-America Friendship Treaty (DAFT) |

| Temporary residence permit duration |

1 year or more, up to a maximum of 5 years for the employment permit |

| Post-arrival registration with the Dutch authorities |

Yes |

| US permit holder can bring dependents to the Netherlands | Yes, depending on permit type |

| Facilities for US nationals married to a Dutch citizen | Naturalization after living together for at least 3 years as married or registered partners |

| Minimum lawful stay before applying for permanent residence | 5 years |

| Minimum time in the country before applying for citizenship | 5 years |

| Naturalization requirements | Having lived in the Netherlands for at least 5 consecutive years with a valid residence permit, 18 years or older, valid identification documents that prove one's nationality, pass the civic integration examination and making a declaration of solidarity |

| Dual citizenship | No, with some exceptions (for example, being born in the Kingdom of Netherlands or married to a Dutch citizen/the registered partner of a Dutch citizen) |

| US pension available in the Netherlands | American citizens who relocate to Netherlands from US can still benefit from U.S. Social Security payments |

| Taxes for US nationals in the Netherlands | Income derived from the Netherlands (employment, homeownership, substantial interest, investments, and real estate in the country) is taxed at the Dutch personal income tax rates There is no double taxation on the same income American citizens living in the Netherlands may have to file 2 tax returns, one in each country |

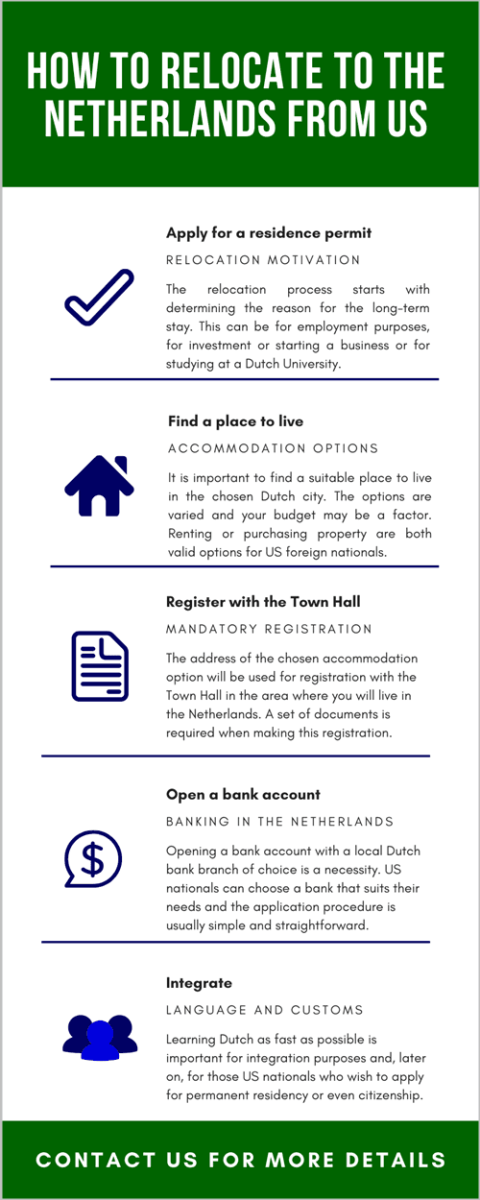

The list below presents a set of issues that are worth taking into consideration before moving from the U.S.A. to the Netherlands:

- Town Hall registration: this is performed at the town hall in your area of residence and in most cases it is mandatory to register with the authorities within five days of the arrival in the country (when the stay is for long periods of time, more than four months); an address is required during this step and if you cannot conclude a rental contract within the five days, then you should accomplish this step as soon as the agreement to rent or purchase a property is signed; for Amsterdam, registration with the Gemeente is required.

- the citizen service number: this is a number that is unique to an individual living in the country and it is obtained after the registration with the Town Hall; it is one of the first things to sort out when moving to the country because it is needed to open a bank account, find a job and enroll in the healthcare system as well as for receiving benefits.

- opening a bank account: this is another mandatory step and it will be needed for receiving the monthly wage as well as making payments since this is a preferred payment method; bank account package options vary and we recommend choosing a bank that meets your needs; one of our Netherlands immigration agents can help you if the language barrier is a hassle at a chosen bank (although many Dutch speak English).

- the DigiD: it is an online ID through which, as an expat, you have access to a number of government services and websites; this is mandatory for tax purposes and for collecting benefits and having access to certain types of allowances; this digital identification is linked to the citizen service number, the BSN; individuals can apply for a DigiD online once they obtain the BSN (and also have an address).

- driving license: for non-EU citizens, the driving license is valid for six months after the registration with the municipality is performed; U.S. expats living in the Netherlands who plan on driving a car after this six-month period will need to take the applicable exams.

These are just some of the issues an expat will need to think about and handle when moving to the Netherlands. For more information about each of these points, reach out to our Netherlands immigration experts.

Residence permits for American citizens moving to the Netherlands

United States citizens who wish to relocate to the Netherlands are not required to obtain a Dutch provisional residence permit (MVV). However, when you wish to emigrate or move to the Netherlands you are required to obtain a residence permit and, when this option becomes available to you, you can apply for a permanent residence permit.

U.S. citizens who want to work in the Netherlands or simply live here are required to apply for a residence permit. A special category exists in the case of highly skilled migrants. American applicants can submit a form for Transfer within a company for positions such as branch managers. Their employer will also need to apply for a Single Permit, which combines the residence permit and the work permit.

Once you have the residence permit, you can extend it as needed. Those who have lawfully lived in the Netherlands for a period of five years can apply for a permanent residence permit. This is a separate application that is submitted with the IND. Apart from having a valid residence permit in Netherlands for five years, the applicant must also have had an uninterrupted stay in the county for those past five years. He/she must be registered with the Municipal Personal Records Database (BRP) that operates in the place of residence. Another important condition is for the applicant to be able to provide for himself. This is done by showing that he or a family member is able to provide for sufficient, independent long-term income.

As a citizen of the USA, you can apply for Dutch citizenship if you have lawfully lived in the country for at least 5 consecutive years. A mandatory condition during your stay is to have had a valid residence permit at all times. Other criteria apply for naturalization and they concern your level of Dutch language knowledge. You can discuss these in detail with our team and receive assistance for citizenship applications.

American entrepreneurs in the Netherlands

The main conditions for residence based on the Dutch American Friendship Treaty are the following:

- the applicant meets the general conditions (listed below by our Dutch immigration agents);

- he or she is an American national;

- the applicant develops and leads a business in the country or has invested a minimum capital amount in a company; for those who represent an American company, a condition is for them to be employed in a key position with that firm; an alternative is for the American applicant to have a liberal profession, a public duty or a position in the healthcare sector.

Some of the costs associated with residing in the Netherlands based on the Dutch American Friendship Treaty include the following:

- have sufficient capital in the business (if opting for opening a company) or have a gross profit per month as a self-employed person or at least € 1,273.71 (including the holiday allowance) – the amount is valid from 1 January 2021 to 30 June 2021;

- pay the application cost of € 1,416;

- when the applicant already has a residence permit start-up then the application costs are lower, at € 379.

Independent American entrepreneurs in the Netherlands need to comply with the requirements concerning the nature of the investment:

- interest: the activity or business will serve an essential interest for the Dutch economy; this means that the product or service must be innovative and meet other criteria as well;

- minimum points: the applicant is evaluated based on a scoring system that takes into consideration three parts: one’s personal experience, the business plan and the aforementioned added value to the country;

- registration: the business needs to be registered with the Trade Register with the Dutch Chamber of Commerce;

- licensing: the applicant needs to have the proper licenses to practice the business/profession;

- income: the criteria for the aforementioned sufficient income is required; this is also highlighted in the business plan.

Additional requirements apply for companies that will provide services in individual healthcare (this is a mandatory step for a healthcare provider who has a diploma issued by a foreign entity).

The general conditions for those applying for a residence permit in the Netherlands are the following:

- have a valid passport; children can be included on the passport of one of the parents;

- sign the antecedents certificate.

Citizens of the USA are not required to take a tuberculosis test.

The documents for the self-employed residence permit or for the residence permit under the Dutch American Friendship Treaty are to be legalized and translated into Dutch, English, French or German.

Start-ups in the Netherlands opened by American investors

A similar residency route for American citizens who wish to immigrate from the USA to the Netherlands is the one based on working in the country as a start-up entrepreneur (as opposed to an entrepreneur who makes another form of investment). Similar to the conditions mentioned above, an important criterion is to present an innovative start-up idea.

The “start-up” residence permit allows American investors to start a company when they are supervised by an experienced facilitator (in the previously mentioned investment route the presence of the facilitator was not a mandatory condition). This is part of the country’s support offered to start-up companies.

The conditions for start-ups opened by American investors are the following:

- have a facilitator: the facilitator is a company or an individual, a business mentor with extensive experience in guiding startups in the country; it is financially stable and it able to provide support without holding a majority interest in the startup and without being a family member up to the third degree; the collaboration between the American investor and the facilitator is confirmed through a signed agreement.

- present an innovative project: the product or service needs to be an innovative one;

- have a business plan: the American entrepreneur will be asked to present a step-by-step plan for the start-up;

- financial means: the applicant will need to show that he has sufficient financial means to reside and live in the country.

The Netherlands is a competitive EU economy and a country that offers many business advantages, among which a favorable location, a good business climate and start-up environment, multilingual employees, and a generally simple company incorporation procedure. US entrepreneurs who are in need of more information on how to obtain a residence permit for opening a start-up can reach out to our Netherlands immigration specialists.

Find out more about moving to the Netherlands from this video:

Relocation services in the Netherlands for citizens of the USA

American citizens who want to immigrate to the Netherlands can request professional help from a team of relocation experts. Our agents are able to help you in the same way as a Dutch immigration lawyer. Our relocation services are tailored to the needs of each new expat, according to his or her preferences for renting or buying a home in a Dutch city or the particularities related to his or her workplace. In case you are interested in immigration to Germany or to another European country, such as Cyprus, we can put you in contact with our partners.

In case you need a highly-skilled migrant visa or any other type of visa, our team is ready to assist you.

Our Netherlands immigration agents can help citizens of the USA who want to immigrate to the Netherlands with the following expat services:

– visa or residence permit submissions;

– Municipal Personal Records Database registration and related submissions;

– renting or buying a home in the Netherlands;

– employment contract evaluation for detailed information on the conditions for workers in the country;

– assistance for opening a bank account and handling other financial matters;

– insurance services.

Our experts are also able to advise you on the applicable tax incentives and/or the special regime that applies to talented foreign workers. The Netherlands has a 30 percent ruling that is essentially a 30 percentage of reimbursement for the expenses incurred for having to move and stay in the Netherlands for your new job. Our Netherlands immigration specialists can give you more information on how this rule applies and what are the employer’s obligations.

We are able to help American citizens who wish to work or live in the Netherlands with permit applications but also with connected services. It is often helpful to request the aid of a local expert when looking to rent or buy a home in the Netherlands. We can also help them obtain any type of Dutch visa, including the DAFT visa or the highly-skilled migrant visa.

Moreover, one of our agents is able to help you look for a property that meets your criteria. Furthermore, we can help you with the required registration with the Municipal Personal Records Database and with other issues such as arranging for life and property insurance in the Netherlands.

Our Netherlands immigration consultants can help you if you are a citizen of the USA who is interested in relocating to the Netherlands. Contact us for more information on relocating, obtaining Dutch citizenship and for personalized answers.